Profile

Industry: Consumer electronics

Sector: Technology

Theme: Digital revolution

5-Year shareholder growth: +16.9%/year

Fair value estimate: $94

Valuation assumption: 6.0% MFCF yield

Insider ownership: 0.06%

Short sellers/put buyers: Fred Hickey (The High-Tech Strategist), Brett Schafer (Chit Chat Stocks)

Estimated fair value history

Dec-23 - $102 (6.0% MFCF yield)

Mar-24 - $96

Jun-24 - $99

Sep-24 - $105

Dec-24 - $94

Mar-25 - $95

Jun-25 - $94

Apple

Location: Cupertino, California

Apple is in the crosshairs of an escalating trade war with China.

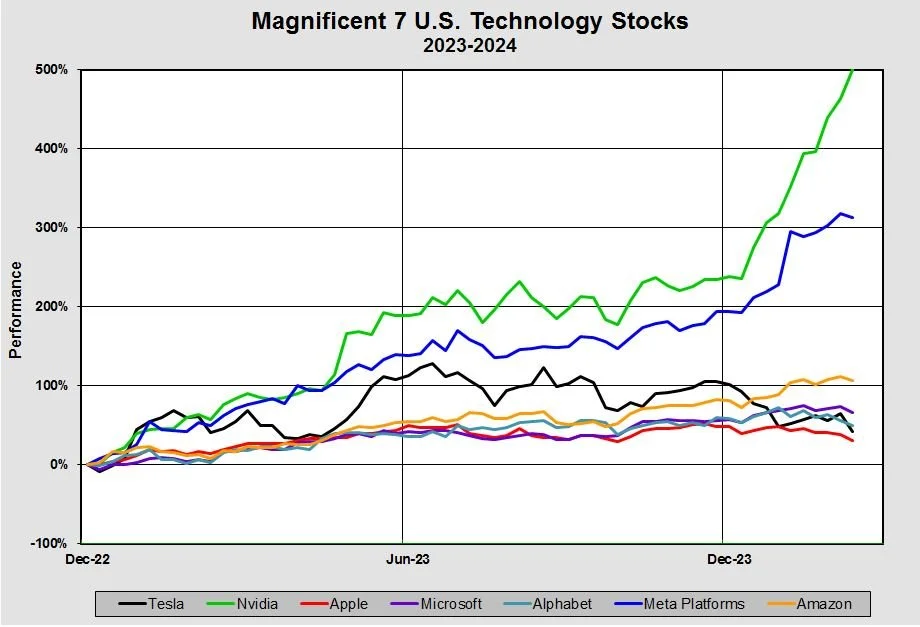

The Magnificent 7 looks more like the Magnificent 4. How much longer can this narrowing rally continue?

Murakami, a maker of rearview mirrors, trades at less than net cash. Is there value in Japan?

A few words on Apple, The Buckle, compounding and Joel Tillinghast’s book, Big Money Thinks Small… [mailbag]

“At the company level, China’s economy looks markedly better than the headlines,” says veteran retail analyst John Zolidis.

Upgrading New Oriental Education from Speculative to Opportunistic.

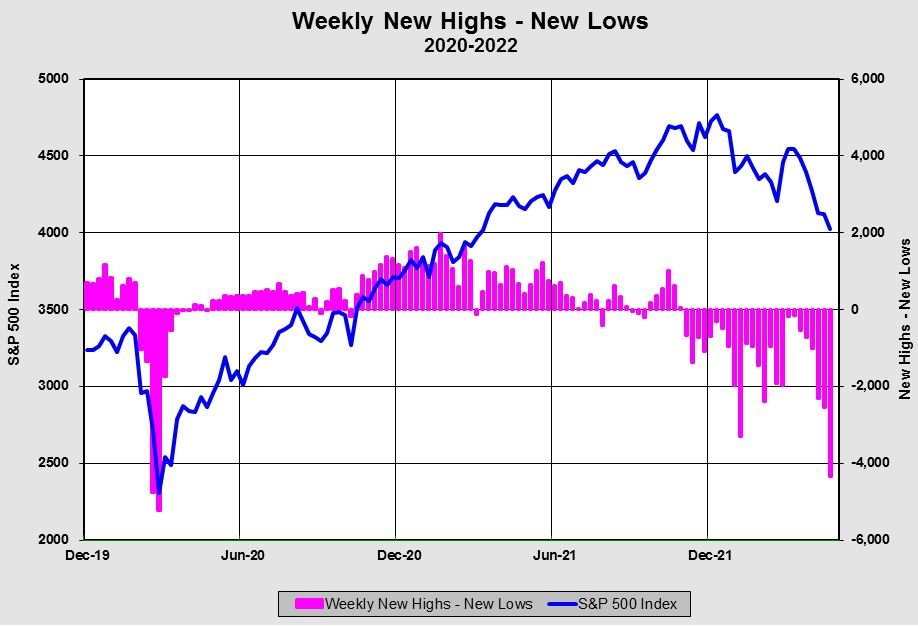

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]