Transaction log

Feb 18, 2020 - Bought 600 @ $13.92 (8.35% wtg, opportunistic)

Mar 13, 2020 - Bought 200 @ $9.91 (800 shares, 7.94% wtg)

Mar 1, 2021 - Bought 100 @ $19.08 (900 shares, 12.13% wtg)

Mar 2, 2022 - Sold 100 @ $22.57 (800 shares, 11.40% wtg)

May 28, 2024 - Sold 100 @ $18.74 (700 shares, 7.10% wtg)

Apr 3, 2025 - Sold 100 @ $28.31 (600 shares, 8.33% wtg)

Oct 20, 2025 - Sold 50 @ $50.64 (550 shares, 11.41% wtg)

Dec 12, 2025 - Sold 50 @ $58.09 (500 shares, 11.09% wtg)

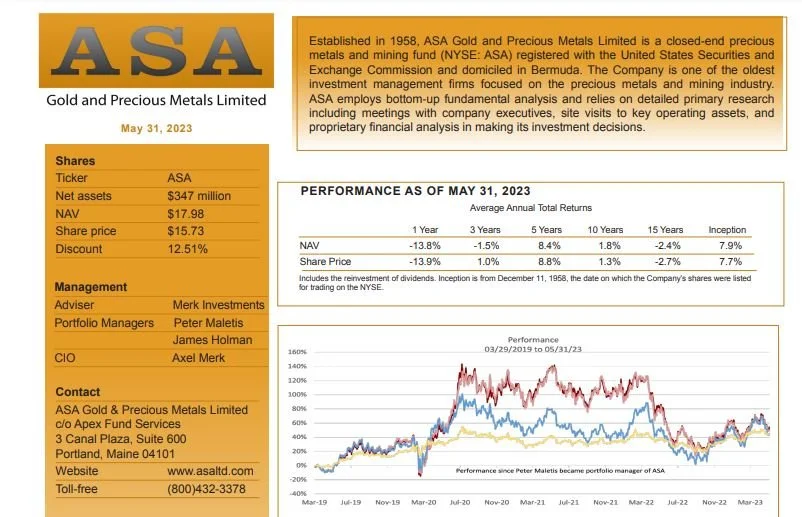

ASA Gold & Precious Metals Ltd.

Location: Menlo Park, California (sub-advisor Merk Investments)

Profile

Industry: Gold mining

Sector: Basic materials

Theme: Inflation not dead

5-Year shareholder growth: n/a

Estimated fair value: $65

Valuation assumption: Net asset value (NAV)

Insider ownership: 0.2%

Investors: Whitney George (SII)

With ASA tripling on the year, we can’t be faulted for taking some profits. [trade]

Precious metals have had an epic run, yet the bull market is likely early. With a 48% weighting in the model portfolio, raising a little cash seems like a prudent move. [trades]

ASA is holding a proxy vote later this week in which activist investor Saba Capital is attempting to control the board and likely change the fund’s mandate. A lot is at stake.

Toto has just pulled back the curtain on the Trump economic team. We're not in Kansas anymore... [trades]

Trimming ASA, adding to Alamos Gold and Five Below. With bullish sentiment extreme, time to add a little portfolio insurance. [trades]

Since recommending Five Below two years ago (and selling 9 months later at a 41% profit), the stock is right back where it started even though the company has grown 25%. Time to buy. [trade]

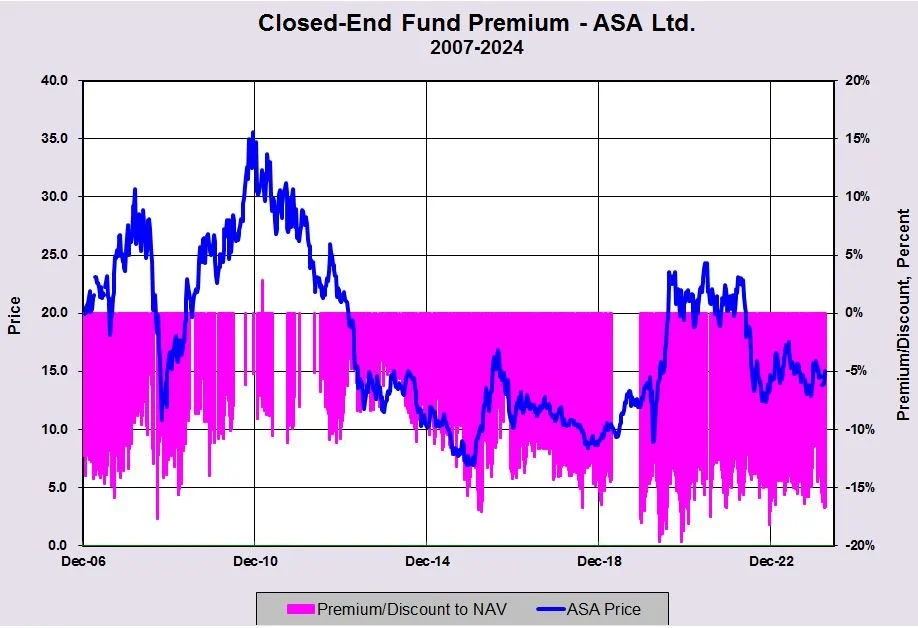

ASA’s 16.6% discount to NAV has attracted activist investor Saba. Why this is a bad idea.

“It’s always darkest before the dawn.” Time to buy Russian stocks? [trades]

With retailers up, gold stocks down, and speculative excesses everywhere, it’s time for a bit of rebalancing. [trades]

The herd is panicked… Are there opportunities for investors amid all the fear? [trades]

In fact, the reports of its death by the financial press are largely exaggerated.