Transaction log

Dec 27, 2021 - Bought 35 @ $42.87 (1.01% wtg, opportunistic)

May 27, 2022 - Bought 25 @ $26.58 (60 shares, 0.99% wtg)

Aug 9, 2022 - Bought 40 @ $22.00 (100 shares, 1.51% wtg)

Mar 2, 2023 - Bought 35 @ $14.67 (135 shares, 1.29% wtg)

Jun 9, 2023 - Downgraded to speculative

Oct 5, 2023 - Sold 135 @ $3.99 (closed, 0% wtg)

Performance

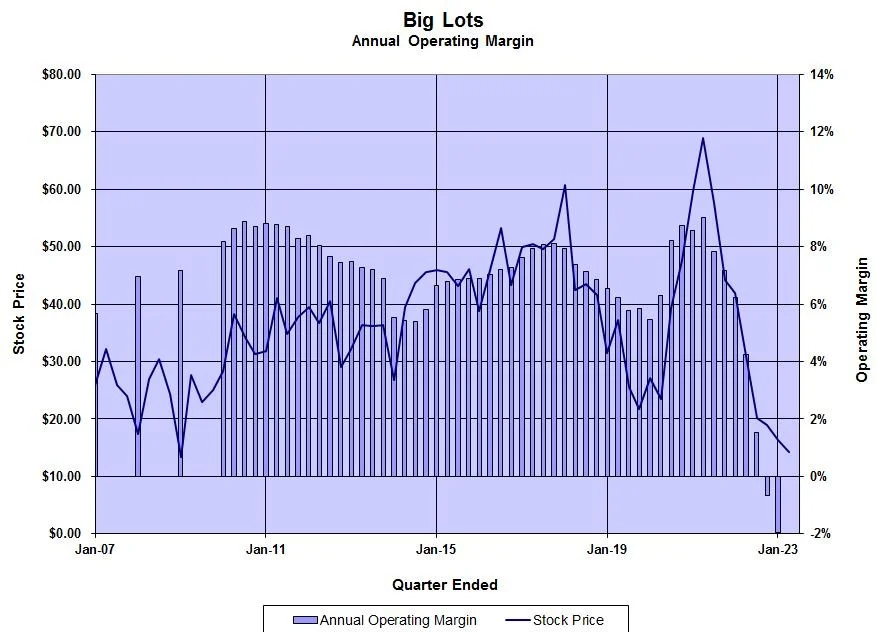

Total return = -81.74%

Coffee Can contribution = -2.91%

Big Lots

Location: Columbus, Ohio

Introducing Coffee Can rule #19: Water the flowers, pull the weeds. [trades]

The company keeping me up most at night is Big Lots. Is this a buying opportunity or death trap? [mailbag]

If BIG can get through this rough patch (no guarantee; the stock is not without risk), they could eventually earn $8.00 assuming operating margins return to 6%. The downside is zero; the upside is easily 5-10x. [trade]

While GAMCO underwhelms with its ESG bona fides, Crocs overwhelms with its HEYDUDE acquisition. R.I.P. Olivia Newton-John. [trades]

Retailers can’t get a break: first lockdowns, now supply chain issues, food and energy inflation, and consumers crying “uncle.” Adding to AEO and BIG. [trades]

Supply chain issues, labor shortages and price inflation have created a hand full of year-end bargains. [trades]