Transaction log

May 16, 2022 - Bought 25 @ $57.03 (0.91% wtg, opportunistic)

Aug 9, 2022 - Bought 20 @ $70.35 (45 shares, 2.24% wtg)

Oct 5, 2023 - Bought 10 @ $84.96 (55 shares, 3.14% wtg)

Aug 7, 2025 - Bought 10 @ $79.25 (65 shares, 2.35% wtg)

Estimated fair value history

Jun-24 - $165 (6.0% MFCF yield)

Sep-24 - $186

Dec-24 - $194

Mar-25 - $201

Jun-25 - $206

Sep-25 - $208

Crocs

Location: Broomfield, Colorado

Profile

Industry: Footwear & accessories

Sector: Consumer discretionary

Theme: Emerging markets consumer

5-Year shareholder growth: +28.7%/year

Fair value estimate: $208

Valuation assumption: 6.0% MFCF yield

Insider ownership: 3.1%

Investors: Brett Schafer (Chit Chat Stocks)

Schafer: “While Crocs ranks low on my competitive advantage rating, it more than makes up for it on my other two pillars (trusting management and cheap price)… If I am right, I think this is a multibagger in short order.”

Bill Fleckenstein calls Wall Street analysts “dead fish” for their inability to think critically and anticipate the future ahead of the crowd. This CROX downgrade is just the latest example.

Crocs is getting body slammed, down 25%, after issuing weak Q3 guidance due in part to tariffs. Overreaction? [trade]

Crocs was down 19% on disappointing Q3 results. Cause for concern or buying opportunity?

AEO and CROX up after reporting better Q4 sales and margins…

Introducing Coffee Can rule #19: Water the flowers, pull the weeds. [trades]

Crocs brand president Michelle Poole: “The key trends we see emerging in China and well-aligned to the Crocs brand are self-expression and personalization, clogs and travel.”

CROX Q2: wholesale snags at HEYDUDE have investors selling, stock down 14%. This feels like an overreaction as the rest of the business is humming, HEYDUDE problems likely short-term in nature. At 9 x earnings, CROX is too cheap.

Does Crocs have legs? A first look at the HEYDUDE acquisition.

While GAMCO underwhelms with its ESG bona fides, Crocs overwhelms with its HEYDUDE acquisition. R.I.P. Olivia Newton-John. [trades]

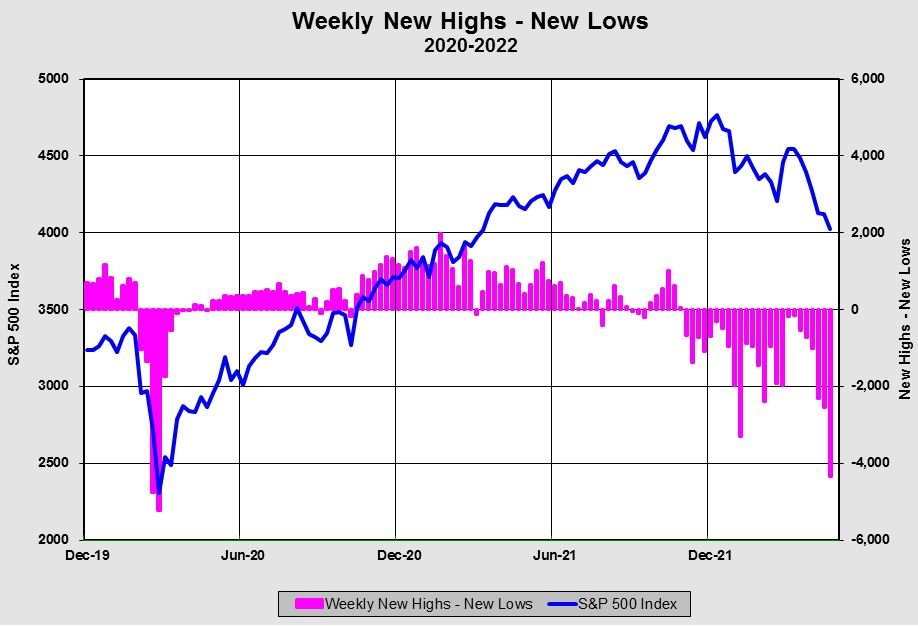

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]