Transaction log

Feb 18, 2020 - Bought 500 @ $5.68 (2.84% wtg, opportunistic)

May 11, 2021 - Sold 100 @ $20.47 (400 shares, 5.44% wtg)

Sep 28, 2021 - Sold 100 @ $22.41 (300 shares, 4.18% wtg)

May 16, 2022 - Sold 100 @ $39.61 (200 shares, 5.41% wtg)

Apr 3, 2025 - Sold 50 @ 52.62 (150 shares, 3.87% wtg)

EQT Corp.

Location: Pittsburgh, Pennsylvania

Estimated fair value history

Dec-24 - $40 (7.0% MFCF yield)

Mar-25 - $45

Jun-25 - $51

Sep-25 - $54

Profile

Industry: Oil & gas exploration & production

Sector: Energy

Theme: Commodity renaissance

5-Year shareholder growth: +45.9%/year

Estimated fair value: $54

Valuation assumption: 7.0% MFCF yield

Insider ownership: 0.78%

Toto has just pulled back the curtain on the Trump economic team. We're not in Kansas anymore... [trades]

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]

Margin debt figures are getting scary. Time to trim some economically-sensitive names and add to a consumer defensive stock. [trades]

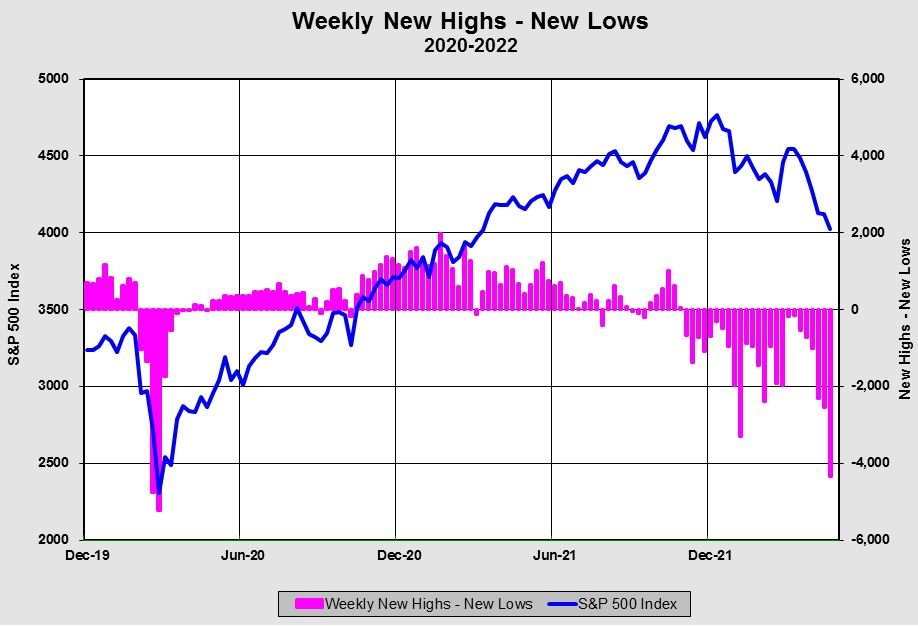

The most speculative stocks peaked in mid-February. Even though the broad averages rallied to new highs, the underlying deterioration has worsened. [trades]

Corporate executives and directors went on a buying spree the past three months in down-and-out stocks.

This overwhelming bounty has depressed prices and wreaked havoc on producers in basins such as the Marcellus Shale in southwest Pennsylvania.