Transaction log #1

Feb 18, 2020 - Bought 500 @ $5.17 (2.59% wtg, portfolio insurance)

Mar 19, 2020 - Sold 300 @ $7.19 (200 shares, 1.72% wtg)

Mar 24, 2020 - Sold 200 @ $6.96 (closed, 0% wtg)

Performance

Total return = +37.29%

Coffee Can contribution = +0.96%

Transaction log #2

Nov 20, 2020 - Bought 300 @ $3.63 (0.82% wtg)

Feb 8, 2021 - Stock split, 1-for-10 (30 shares, 0.53% wtg)

Jan 19, 2021 - Sold 30 @ $29.91 (closed, 0% wtg)

Performance

Total return = -17.60%

Coffee Can contribution = -0.19%

AdvisorShares Ranger Equity Bear ETF

Location: Bethesda, Maryland

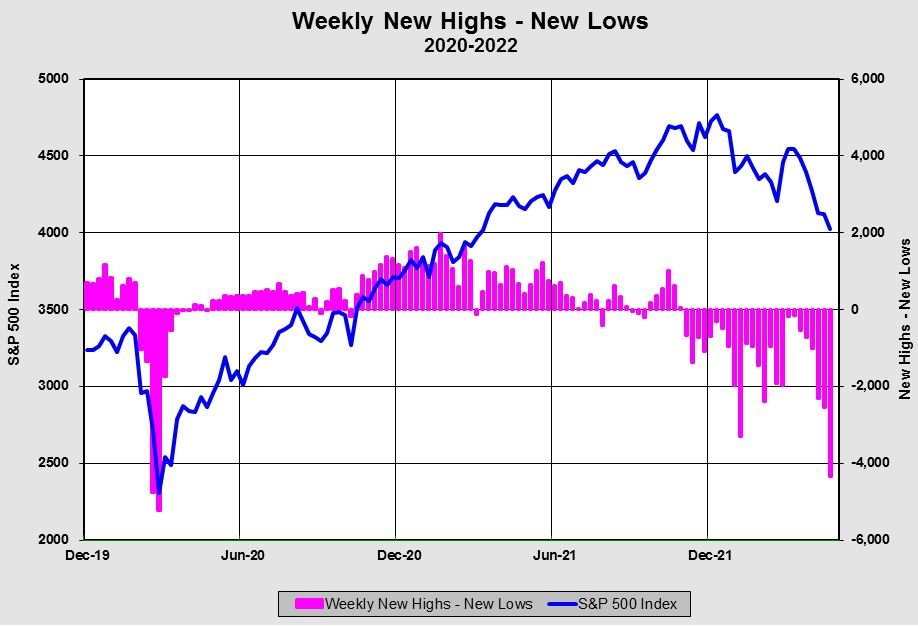

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]

With all the post-stimulus, post-election, post-vaccine euphoria, perhaps it’s time to add more portfolio insurance. [trades]

It is across the index divide that bargains abound… Active managers, after a decade of lagging the S&P 500 and having assets taken away, are looking at a ideal fishing conditions. [trades]

If you think the world is not coming to an end (my best guess), it's probably time to buy quality retailers at bargain prices. This too shall pass and the sun will come out. [trades]

Yesterday's rout in stocks and crude oil had the smell of panic… This panic is creating opportunity… [trades]