Transaction log

Feb 18, 2020 - Bought 35 @ $43.83 (1.53% wtg, opportunistic)

Mar 13, 2020 - Bought 30 @ $22.33 (65 shares, 1.80% wtg)

Aug 18, 2020 - Bought 35 @ $19.86 (100 shares, 1.51% wtg)

Jan 27, 2021 - Sold 20 @ $47.11 (80 shares, 2.54% wtg)

May 11, 2021 - Sold 30 @ $57.46 (50 shares, 1.95% wtg)

Mar 30, 2022 - Bought 20 @ $29.35 (70 shares, 1.39% wtg)

Jul 1, 2024 - Sold 30 @ $22.35 (40 shares, 0.52% wtg)

Apr 8, 2025 - Sold 40 @ $6.66 (closed, 0% wtg)

Performance

Total return = -62.62%

Coffee Can contribution = -1.22%

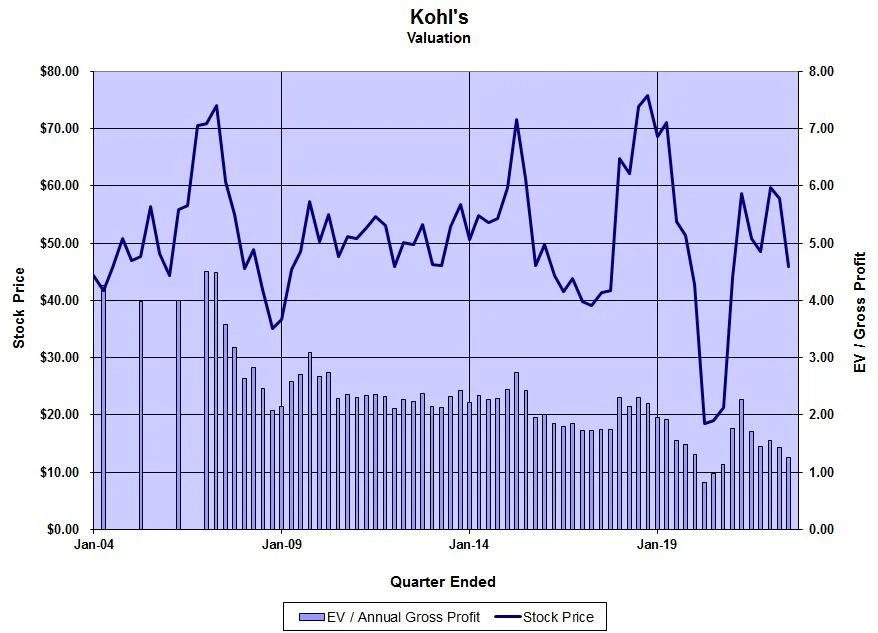

Kohl’s

Location: Menomonee Falls, Wisconsin

Profile

Industry: Department stores

Sector: Consumer discretionary

Theme: Retailers survive Amazon.com threat

5-Year shareholder growth: -15.9%/year

Fair value estimate: $17

Valuation assumption: 0.5 x tangible book value

Donald Trump’s trade war black swan lurks. Probably not a bad time to stress-test the portfolio and get a bit more defensive. [trades]

Kohl’s trades like it’s going out of business. Are there better turnaround opportunities among retailers?

While Kohl’s stock has been left for dead, the company is alive and kicking.

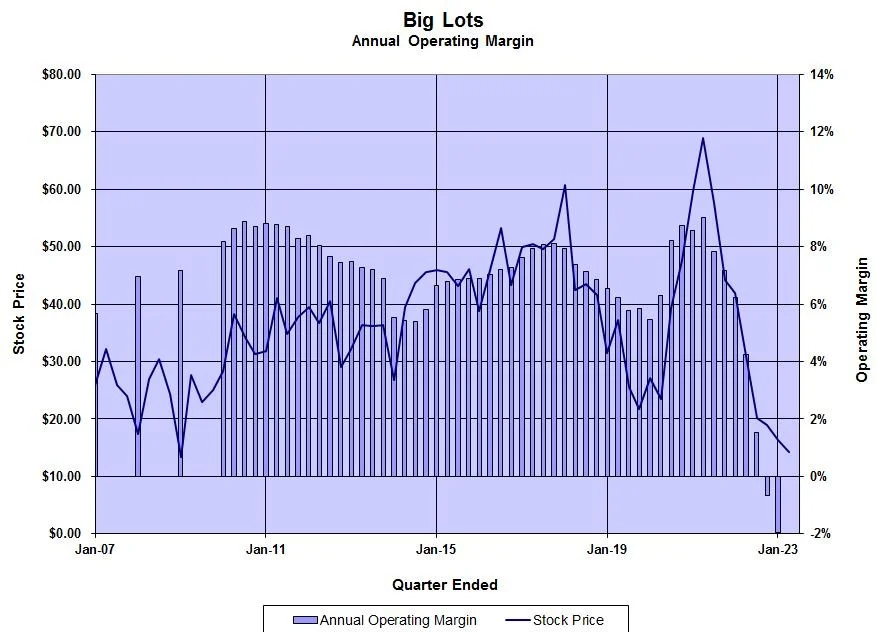

If BIG can get through this rough patch (no guarantee; the stock is not without risk), they could eventually earn $8.00 assuming operating margins return to 6%. The downside is zero; the upside is easily 5-10x. [trade]

While gold has held up ok, gold stocks have been dragged down with other risk assets. Buying Fred Hickey favorite Alamos Gold, adding to Kohl’s… [trades]

The most speculative stocks peaked in mid-February. Even though the broad averages rallied to new highs, the underlying deterioration has worsened. [trades]

Speculation is off the charts, surpassing the 2000 dot-com bubble. On what planet is GameStop, a company heading towards banktuptcy, worth $21.7 billion? This will not end well. We're taking profits in some of our retailers which have rallied in sympathy. [trades]

Stock -16% on Q2 earnings miss. I continue to like Kohl’s as a survivor in the depressed department store space… [trade]

Corporate executives and directors went on a buying spree the past three months in down-and-out stocks.

The herd is panicked… Are there opportunities for investors amid all the fear? [trades]

Neither company is setting the world on fire, though they’re holding their own in a tough retail environment… What these companies lack in growth, however, they make up for in cash generation.