Transaction log

Jul 26, 2021 - Bought 50 @ $52.10 (1.63% wtg, opportunistic)

Dec 27, 2021 - Bought 25 @ $38.70 (75 shares, 1.75% wtg)

Mar 30, 2022 - Bought 25 @ $31.58 (100 shares, 1.79% wtg)

May 16, 2022 - Bought 50 @ $26.60 (150 shares, 2.62% wtg)

Nov 2, 2022 - Bought 50 @ $20.44 (200 shares, 3.08% wtg)

Jan 22, 2024 - Bought 100 @ $23.09 (300 shares, 4.42% wtg)

Aug 12, 2024 - Bought 50 @ $26.72 (350 shares, 5.30% wtg)

KraneShares CSI China Internet ETF

Location: New York, New York

Profile

Industry: Internet retail, internet content & information, real estate services, travel services, etc.

Sector: Consumer discretionary, communication services, etc.

Theme: Emerging markets consumer

5-Year shareholder growth: n/a

Estimated fair value: $44

Valuation assumption: Alibaba as proxy, 6.0% MFCF yield

A future subscriber writes from Australia, “Why isn’t Tencent in the model portfolio?”

In September, local Chinese investors will finally be able to invest directly in Alibaba.

Adding two more China plays: Lululemon and Yum China. [trades]

Alibaba’s co-founder and chairman bought $201M worth of stock in Q4.

China gloom has hit a new high. For diehard contrarians, what's not to love? [trades]

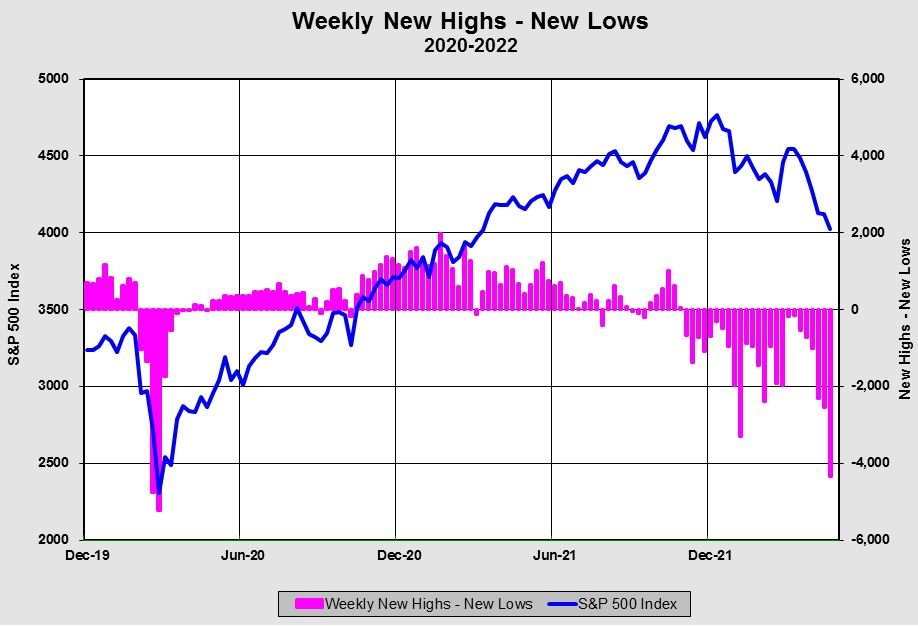

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]

Taking our profits on Bed Bath & Beyond, thank you very much. Still building a position in KWEB. [trades]

Supply chain issues, labor shortages and price inflation have created a hand full of year-end bargains. [trades]

China’s private tutoring industry has taken the brunt of government crackdowns. Are we at the point of maximum pessimism? [trades]