Profile

Industry: Semiconductors

Sector: Technology

Theme: Artificial intelligence

5-Year shareholder growth: +71.8%/year

Estimated fair value: $76

Valuation assumption: 3.5% MFCF yield

Insider ownership: 4.2%

Investors: Tom Slater (Baillie Gifford)

Put buyers: Fred Hickey (The High-Tech Strategist)

Transaction log

Sep 3, 2025 - Bought 200 NVDD @ $4.30 (0.38% wtg, portfolio insurance)

Sep 25, 2025 - Bought 200 NVDD @ $4.14 (400 shares, 0.70% wtg)

Sep 29, 2025 - Stock split, 1-for-10 (40 shares, 0.66% wtg)

Nov 4, 2025 - Bought 25 NVDD @ $36.39 (65 shares, 1.00% wtg)

Dec 29, 2025 - Bought 20 NVDD @ $38.18 (85 shares, 1.21% wtg)

Nvidia

Location: Santa Clara, California

Estimated fair value history

Oct-24 - $61 (2.5% MFCF yield)

Jan-25 - $73

Apr-25 - $71 (3.0% MFCF yield)

Jul-25 - $78

Oct-25 - $76 (3.5% MFCF yield)

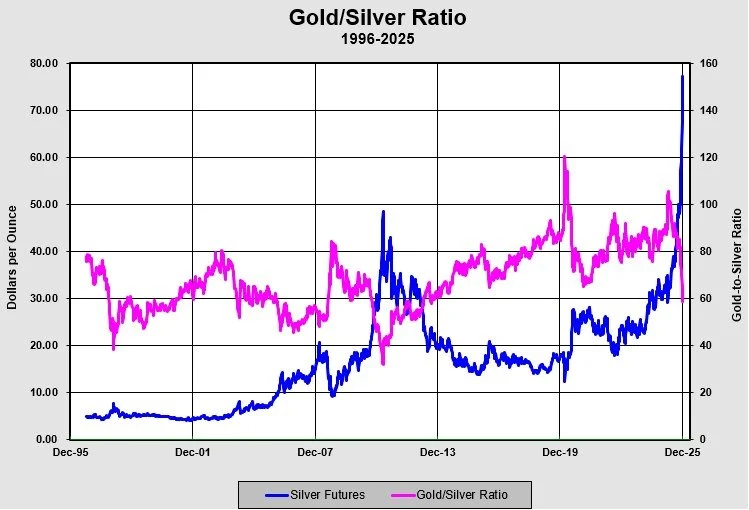

With signs of froth becoming more apparent, we’re selling Pan American Silver and adding to our AI bubble short bets. [trades]

As Peter Atwater likes to say, bubbles unwind on a LIFO basis. If so, Oracle’s major reversal is telling us something. Time to grab a parachute and add to our portfolio insurance. [trades]

AI darling Nvidia boasts a market cap of nearly $5 trillion. Add another chapter to Extraordinary Popular Delusions and the Madness of Crowds. [trade]

Nvidia is goosing demand for its GPUs by infusing its customers with cash. This brings back bad memories of the dot-com bubble (vendor financing).

Bonus feature: the insane valuation gap between Tesla and BYD. [trades]

I’ve decided to dip my toe in the single-stock bear ETF water as the bear cases for Nvidia and Tesla are too tempting to pass up. [trades]

No shortage of ideas (picks and pans) from this year’s midyear roundtable!

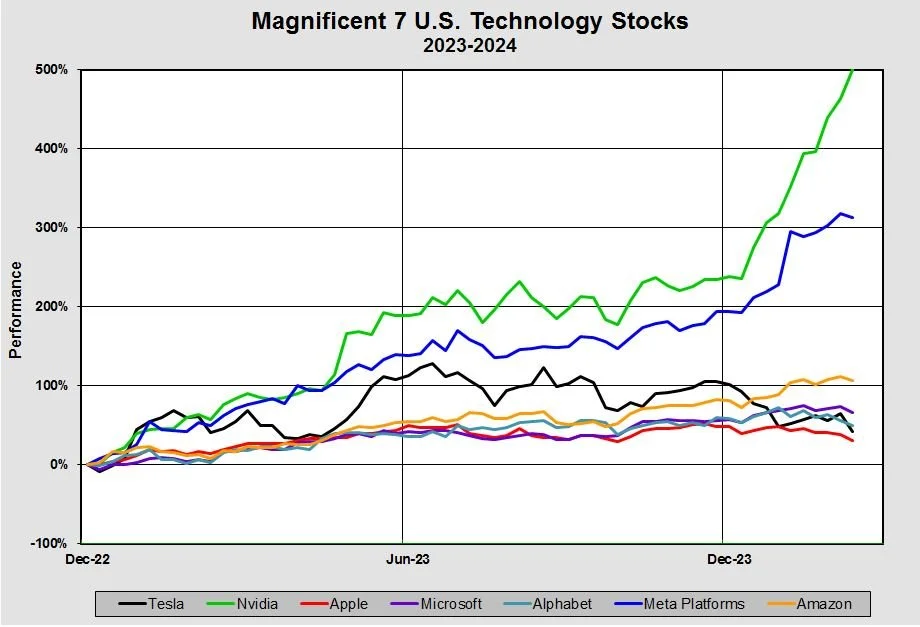

The Magnificent 7 looks more like the Magnificent 4. How much longer can this narrowing rally continue?

Time to go bargain hunting in Asia. Also adding to portfolio insurance ahead of Nvidia earnings after the close. [trades]

Nvidia’s gain is the rest of the industry’s pain. Fred Hickey sounds the alarm. Orders from China may be fueling the Nvidia bubble.