Transaction log

Apr 27, 2020 - Bought 25 @ $22.15 (0.53% wtg, portfolio insurance)

May 6, 2020 - Bought 50 @ $21.71 (75 shares, 1.51% wtg)

Jun 10, 2020 - Bought 50 @ $19.27 (125 shares, 2.08% wtg)

Sep 8, 2020 - Bought 75 @ $16.90 (200 shares, 2.69% wtg)

Nov 11, 2020 - Bought 50 @ $15.76 (250 shares, 3.14% wtg)

Jan 19, 2021 - Bought 50 @ $14.35 (300 shares, 3.02% wtg)

Feb 8, 2021 - Bought 50 @ $13.51 (350 shares, 3.27% wtg)

May 11, 2021 - Bought 50 @ $13.78 (400 shares, 3.55% wtg)

Jun 12, 2023 - Bought 100 @ $11.08 (500 shares, 3.46% wtg)

Feb 21, 2024 - Bought 300 @ $9.23 (800 shares, 4.55% wtg)

Apr 10, 2024 - Split 1-for-5 (160 shares, 4.14% wtg)

May 28, 2024 - Bought 20 @ $42,81 (180 shares, 4.23% wtg)

Jul 16, 2024 - Bought 20 @ $39.30 (200 shares, 4.31% wtg)

Dec 23, 2024 - Bought 25 @ $36.69 (225 shares, 4.67% wtg)

Apr 8, 2025 - Bought 25 @ $43.36 (250 shares, 5.74% wtg)

May 19, 2025 - Bought 25 @ $35.97 (275 shares, 4.81% wtg)

Jul 7, 2025 - Bought 25 @$33.77 (300 shares, 4.65% wtg)

ProShares Short QQQ ETF

Location: Bethesda, Maryland

Investors are giddy and economic black swans stacking up, not a good combination. [trades]

The government’s dysfunctionality knows no bounds. Time to get more defensive. [trades]

Donald Trump’s trade war black swan lurks. Probably not a bad time to stress-test the portfolio and get a bit more defensive. [trades]

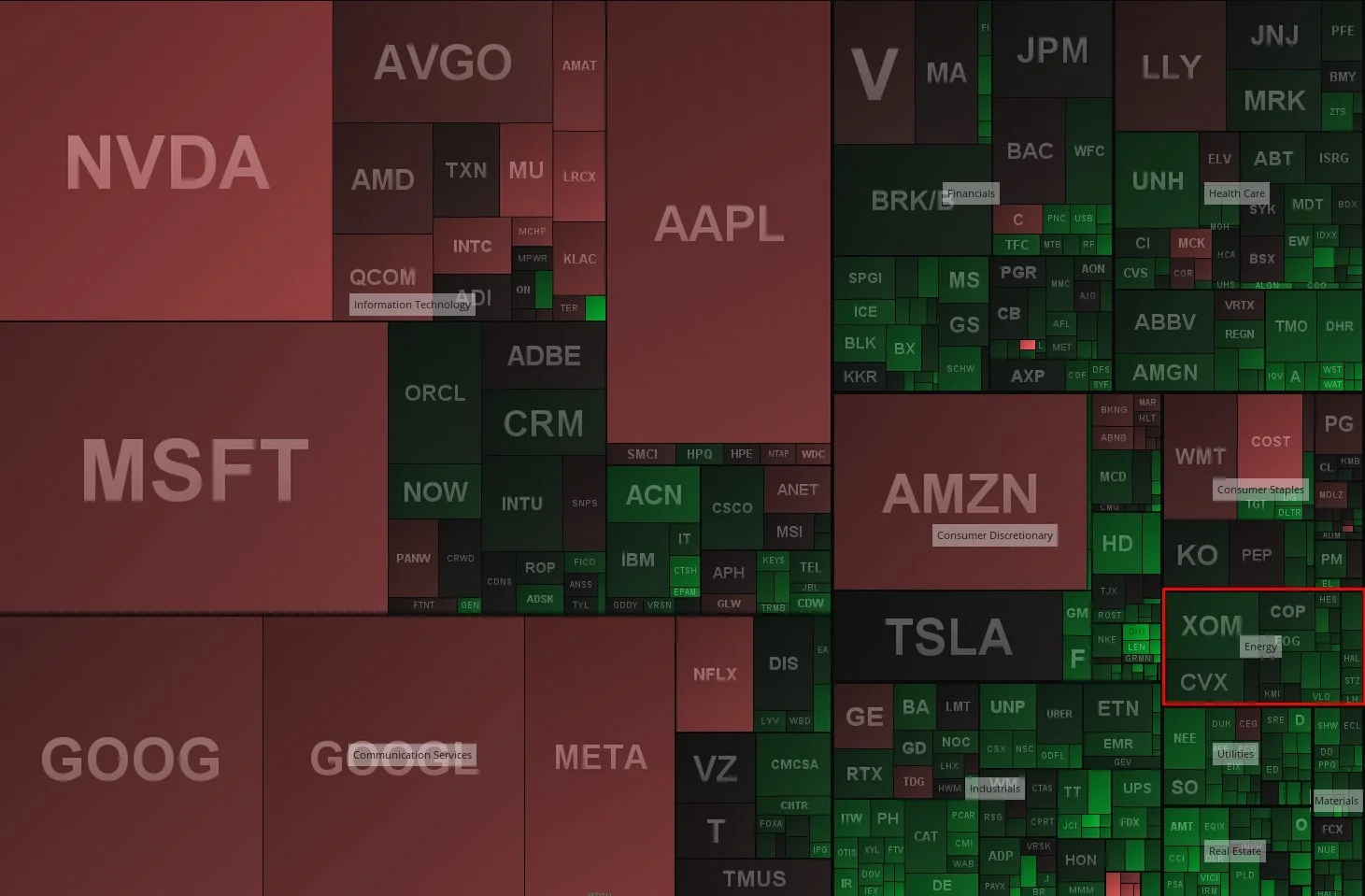

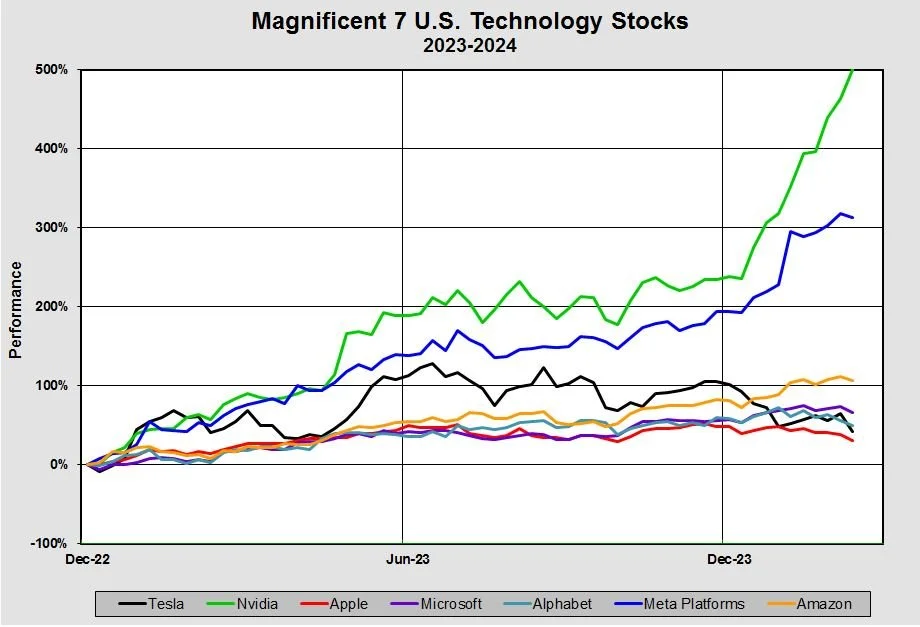

Market froth, excessive Big Tech valuations = time to add to QQQ bear ETF. [trade]

When bubbles reverse, they often do so violently. That appears to be happening as the Russell 2000 has outperformed the Nasdaq 100 by 10% in less than 4 full trading days. [trade]

Trimming ASA, adding to Alamos Gold and Five Below. With bullish sentiment extreme, time to add a little portfolio insurance. [trades]

The Magnificent 7 looks more like the Magnificent 4. How much longer can this narrowing rally continue?

Time to go bargain hunting in Asia. Also adding to portfolio insurance ahead of Nvidia earnings after the close. [trades]

Despite checking a lot of boxes, Zoom committed a cardinal sin: issuing stock options like it’s candy. Time to take our lumps and move on. [trades]

The most speculative stocks peaked in mid-February. Even though the broad averages rallied to new highs, the underlying deterioration has worsened. [trades]

Right now, gold stocks are on sale and stock prices high (putting it mildly). Adding to Regeneron. [trades]

With speculation off the charts, margin debt cracking $700 billion for the first time and a new administration committed to spending, borrowing and printing its way to prosperity, it seems prudent to play a bit more defense… [trades]

With all the post-stimulus, post-election, post-vaccine euphoria, perhaps it’s time to add more portfolio insurance. [trades]

The running of the bulls could turn bloody. Adding to portfolio insurance. [trade]

"Never confuse brains with a bull market." That's exactly what Millennial traders are doing these days. [trades]

Is it possible the economic patient's immune system was already weakened by decades of stimulants and painkillers? More of the same could do him in. [trades]

"Buy when there's blood in the streets." This adage certainly applies to retailers severely impacted by government shutdowns. [trades]