Profile

Industry: Auto manufacturing

Sector: Consumer discretionary

Theme: Autonomous driving

5-Year shareholder growth: +21.6%

Estimated fair value: $71

Valuation assumption: 4.0% MFCF yield

Insider ownership: 11.8%

Investors: Tom Slater (Baillie Gifford)

Short sellers/put buyers: Fred Hickey (The High-Tech Strategist), Brett Schafer (Chit Chat Stocks)

Transaction log

Sep 3, 2025 - Bought 100 TSLS @ $7.30 (0.32% wtg, portfolio insurance)

Sep 25, 2025 - Bought 100 TSLS @ $5.57 (0.47% wtg)

Dec 15, 2025 - Bought 100 TSLS @ $4.88 (0.56% wtg)

Dec 29, 2025 - Bought 100 TSLS @ $4.88 (0.73% wtg)

Tesla

Location: Austin, Texas

Estimated fair value history

Jun-25 - $73 (4.0% MFCF yield)

Sep-25 - $71

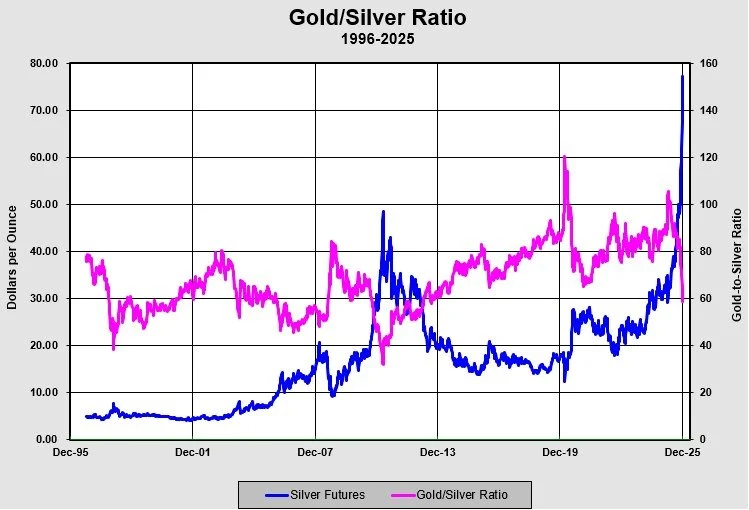

With signs of froth becoming more apparent, we’re selling Pan American Silver and adding to our AI bubble short bets. [trades]

As Peter Atwater likes to say, bubbles unwind on a LIFO basis. If so, Oracle’s major reversal is telling us something. Time to grab a parachute and add to our portfolio insurance. [trades]

Nvidia is goosing demand for its GPUs by infusing its customers with cash. This brings back bad memories of the dot-com bubble (vendor financing).

Bonus feature: the insane valuation gap between Tesla and BYD. [trades]

I’ve decided to dip my toe in the single-stock bear ETF water as the bear cases for Nvidia and Tesla are too tempting to pass up. [trades]

Hesai Group co-founder David Li talks about the great autonomous vehicle debate: Which technology will prevail, cameras or LiDAR? Li says both.

The future of electric vehicles and autonomous driving looks bright.

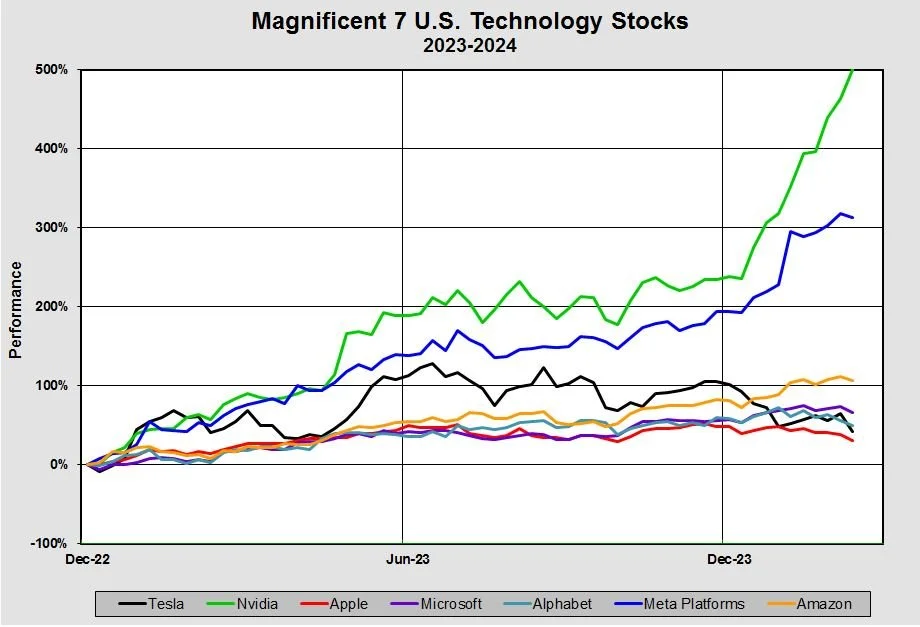

The Magnificent 7 looks more like the Magnificent 4. How much longer can this narrowing rally continue?